Crypto Fiat Exchange Networx (CFXN) Margin Trading Guide

With the rise in popularity of cryptocurrencies, margin trading on this volatile asset has opened up new and potentially lucrative possibilities. In this article, we’ll show you how to trade crypto on margin and how to do so using Prime XBT. We’ll also go over the advantages and disadvantages of crypto margin trading, as well as how to get started.

What is margin trading?

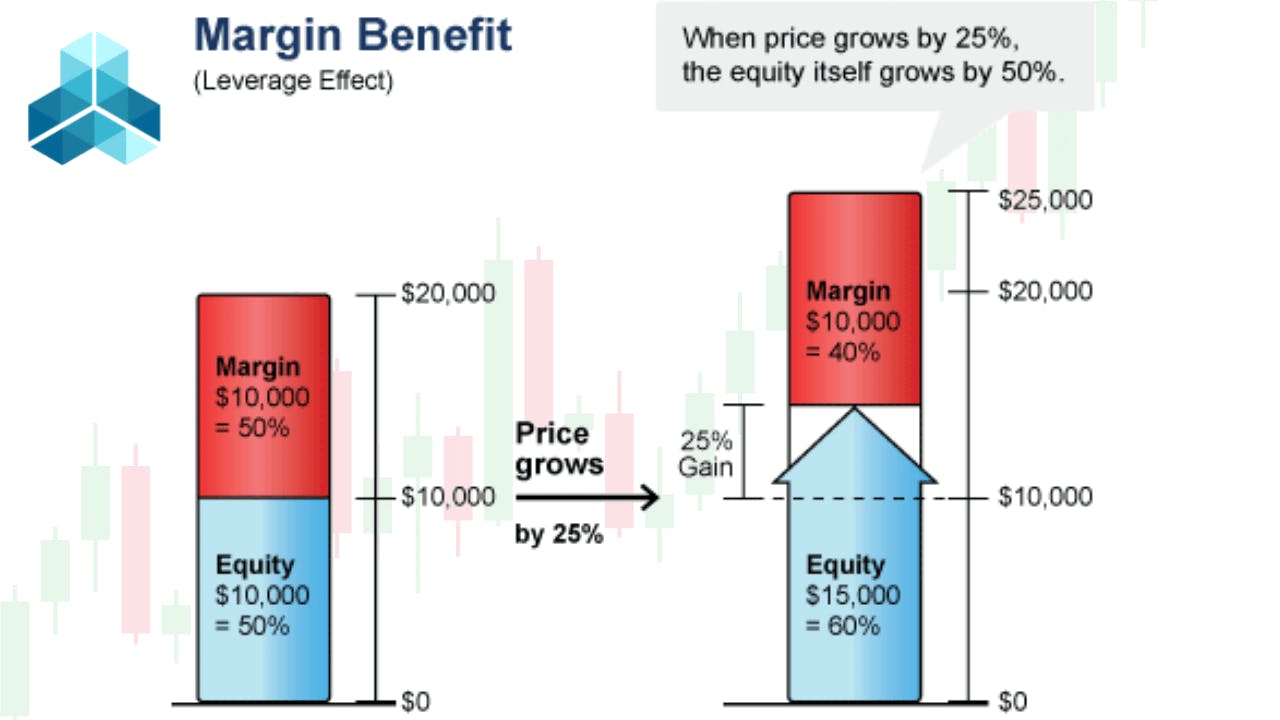

Leverage is used in crypto margin trading to multiply the results of a trade. The margin is the amount a trader has deposited in their account. A margin trading broker will give traders a leverage quotation, which is commonly displayed as a ratio (e.g., 1:5) or a multiple (e.g., 5x), indicating that for every 1 Bitcoin (or other base crypto) placed, they will get 5 Bitcoin (or another base crypto) back.

The broker permits traders to borrow money to open more visible positions. This will have to be repaid in full, but the trader will be able to keep the gains. If your leverage is 1:5, you’ll have $5,000 to trade with if you deposit $1,000. If you use this to buy Ethereum and the price rises 5%, you’ll end up with $5,250 in ETH. If you complete your deal at that point and repay the $4,000 borrowed, you’ll be left with $1,250 and a profit of $250. You would have made a $50 profit if you had executed the same trade in your spot account.

If the price of crypto goes awry after you open your position — say, down instead of up — the crypto exchange will “margin call” your trade when the price reaches a point where you begin losing the borrowed funds. So you’d have to continue increasing funds above that threshold to avoid getting margin calls and losing your trade.

Why trade on margin?

1. Short sales: Short selling frequently employs the concept of margin. When you short sell cryptocurrencies, you’re betting that their price will fall at some point in the future, a process that’s commonly referred to as “shorting.” Trading on margin increases the size of a short position and thus its earnings. However, the contrary is also true: if the deal goes wrong, the potential for losses might be significant.

2. Managing risk: Traders also use margin as a risk management strategy to limit or hedge their losses. You can, for example, hedge a long bet on the price trajectory of an asset by shorting the same asset with an equivalent or lesser amount.

Assume you have $10,000 in your trading account, and your broker permits you to borrow up to 50% of that amount, or $5,000 in the margin. The value of your trading account rises to $15,000 as a result. You could get $150 if your purchased shares grow 10%. Conversely, if they fall 10%, you’ll lose $150, or $50 more than if you hadn’t borrowed anything at all.

How does margin trading work in cryptocurrency?

Cryptocurrency trading, let alone crypto margin trading, is not offered by most traditional brokerages. Because of the volatility of cryptocurrencies, individual traders have been deterred from making large bets with margin trading funds. Institutional investors, according to statistics, do 70% of all current cryptocurrency trading using API calls. In place of brokerages, cryptocurrency exchanges have become popular places to trade on margin. However, this service is not available in all exchanges.

For the exchanges that allow margin trading, leverage amounts and interest rates vary depending on customer demand and regulatory variables in various geographical jurisdictions. Some European exchanges, for example, allow for up to 125X leverage on specified futures contracts. Furthermore, margin loan interest rates change with the currency rate. Some lenders, for example, impose an annual interest rate, while others charge an hourly rate.

According to a prevalent misperception regarding trading on margin with cryptocurrency, individual traders can perform arbitrage techniques between different geographical areas. However, this isn’t accurate: Some regulated cryptocurrency exchanges only allow nationals or expatriates living in the country to trade. Moreover, by adhering to strong Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations that require proof of identification of each user who uses the exchange platform in that country, exchanges assist in the implementation of all-important regulatory and compliance rules.

Tips to keep in mind when trading cryptocurrency on margin

To begin with, the bitcoin asset class is not uniformly regulated throughout the world, which might be detrimental to your trade. For example, a cryptocurrency exchange ban, such as the one enforced by China in 2017, could ruin the value of your assets.

Second, bitcoin and cryptocurrency tokens represent a novel asset class, with price fluctuations that previously followed unpredictable patterns with little to no link to conventional markets’ technical or fundamental analytic ideas. Margined bitcoin trades may therefore result in larger gains or losses, so margin trading should only be done by experienced traders who are familiar with risk management.

Finally, margin trading necessitates an in-depth knowledge of the worldwide bitcoin market. There are practically hundreds of bitcoin exchanges all around the globe. Some of them are not trustworthy, and using them might result in losing your invested funds. As a result, before you consider margin trading, especially bitcoin margin trading on a crypto exchange, you should extensively investigate the platform you intend to utilize.

Get to learn more about Crypto Fiat Exchange Networx by reaching out to one of its co-founders at tdb@cfxnx.com